Rupert Murdoch’s Manchester United? How BSkyB nearly bought the Red Devils

Twenty years ago, on a wave of TV money and digital fear, Sky tried to buy the world’s biggest club. Gary Parkinson recalls a world of shares, shocks and resent

It started with a business lunch. On 1 July 1998, Manchester United’s chief executive Martin Edwards tucked in the napkins with club lawyer Maurice Watkins and BSkyB chief exec Mark Booth. Having arrived in the somewhat unglamorous surroundings of a drab industrial park near Heathrow Airport, the United chief settled down to hear his opposite number talk about the potential of pay-per-view channels.

Instead, Booth dramatically upped the ante by announcing that his boss Rupert Murdoch wanted to buy United. Clearly, this called for a side order of chips.

United for sale

Edwards was no stranger to takeover talk. Partly unsettled by his unpopularity among the club’s support – expertly tweaked by Alex Ferguson whenever the team required investment – he had made it clear that he would sell at the right price, even if it meant ending his family’s 40-year presence on the United board. His father Louis Edwards had bought the shares to make himself a director the day after the Munich air disaster; chairman from 1965 to his death in 1980, Louis was succeeded by his son Martin.

One way or another, the younger Edwards had spent 15 years courting the investment he knew the club needed. He’d met Robert Maxwell to discuss a £10m bid in 1984, albeit rather grudgingly and mainly as a favour to a longstanding United director who knew the tubby tycoon, and quickly withdrew amid fan fury.

Five years later, Michael Knighton got much further – as far as embarrassing himself with keepy-uppies in front of the Stretford End. While Edwards had his doubts about the property developer, he knew the ground needed an expensive renovation – especially the crumbling Stretford End, for which Knighton promised a £10m makeover. He offered the same amount for Edwards’ 50.2% majority share.

When that deal collapsed, Edwards unsuccessfully offered it to fellow director Amer Al Midani for £15m. Al Midani had another nibble in 1991, heading a consortium which would have installed Bobby Charlton as chairman, but by then Edwards’ asking price had doubled.

The best features, fun and footballing quizzes, straight to your inbox every week.

So instead of seeking one buyer, United sought millions. On 31 May 1991, the club floated on the London Stock Exchange, selling 2,597,404 shares at £3.85 each, while retaining Edwards’ majority stake. The very public graph of United’s share price soon started to curve impressively upwards.

As it did so, Edwards realised the value in his own shares by gradually, quietly selling them off. He sold 1.6 million shares in March 1996 and another 2.2m that June, slicing his stake to 17.2% but raising £16.6m in the latter sale alone. As chief executive, he didn’t require majority shareholding to steer the club, and he was still welcome to the idea of a takeover from a rich outside source. But who would have that sort of cash?

TVFC

In the early 1990s, television had revolutionised English football with a huge new £304m five-year deal ushering in the Sky-underwritten Premier League era. Recently renegotiated, the upcoming four-year deal had rocketed to £670m. But by the late 1990s, TV companies didn’t just want to fund clubs: they wanted ownership.

Largely thanks to football-driven subscriptions and advertising, BSkyB was Britain’s most profitable broadcaster. But the heavy investment in content wasn’t a sustainable model, particularly if the clubs would soon take their ball home.

By the digital dawn of the late 1990s, the accepted wisdom was that the Premier League’s collective bargaining would soon disintegrate in the sort of me-first fiscal selfishness that had led to the Premier League’s formation in the first place. The viewing figures clearly showed that United, Liverpool, Arsenal and the other big-name clubs attracted far more interest than your Boltons and Barnsleys. The feeling was that clubs would inevitably split their own cartel to strike individual TV deals with broadcasters, their matches to be accessed via subscription or pay-per-view.

Speaking to The Independent in April 1999, specialist football fund manager Tony Fraher was in no doubt whatsoever. “It is now fairly clear that, when the current Sky deal runs out in 2001, every club will be negotiating its own deals for the rights to broadcast its home games,” he insisted, before going further with a bold claim: “I reckon that 16 out of the 20 current Premiership clubs will be taken into media ownership within the next two years.”

Broadcasters wanted to own part of the content-creation machine, partly to enjoy some of the Premier League profits, but also to get on the gravy train. With BSkyB dominant, rivals wanted a piece of the action.

Luckily for them, shares in clubs were never more available than in the mid-90s. As more clubs rushed to the stock market, hoping to replicate United’s success – 18 clubs floated between October 1995 and October 1997 alone – so it became easier for broadcasters to buy in. As Fraher put it, “If you’re running a TV channel, you want people to watch, and football is one of the biggest draws. And the best way to ensure you have football is to buy a football club.”

So in 1998, Granada paid £22m to buy 9.9% of Liverpool; the following year it spent £47m to take just 5% of Arsenal shares and establish a broadband joint venture, with a further commitment to plough another £30m in for 4.99% more when planning permission for the new stadium at Ashburton Grove was granted.

Meanwhile, cable-TV company NTL spent hundreds of millions between 1998 and 2000, buying stakes in Celtic, Rangers, Newcastle, Middlesbrough, Aston Villa and Leicester through its subsidiary Premium TV. These were eye-watering figures for a broadcast medium which was panicking at the thought of its own cosy monopoly ending with the advent of digital TV; some were even muttering that this newfangled internet might be a problem, too.

But the biggest deal of all was the one that started to be thrashed out that day near Heathrow. It made sense for the dominant broadcaster to try to buy into the dominant team – although thwarted by newcomer Arsene Wenger’s Arsenal in 1998, United had won four of the first five Premier League titles. Even so, the size of the bid was astonishing. To take control of Manchester United, BSkyB were offering north of half a billion pounds.

NEXT: I want my MUTV

I want my MUTV

Clubs had also been quick to recognise the marketing potential of setting up their own channel. If these incredibly brand-loyal consumers have already got a satellite TV, went the reasoning, clubs could have their own slice of the rapidly expanding broadcast spectrum and fill its schedule with old clips, talking heads and fandom. It might be more Pravda than Washington Post but who cares when you control the means of dissemination?

If what TV companies wanted was content, what they offered (besides cold hard cash) was broadcast know-how. As if to set a fiendishly difficult pub quiz question, the world’s first club-specific TV channel was Boro TV, launched in February 1998 by NTL’s Premium TV.

But the biggest name was MUTV, and it brought together three very big hitters in a giant joint venture: taking equal 33.3% shares were United, BSkyB and ITV. United would bring the brand, the broadcasters the brains – and the content would drive subscriptions, helping to establish digital TV in the same way Premier League footage had spent the previous half-decade pinning bin lids to the outside of everyone’s houses.

MUTV launched on Thursday, 10 September 1998, but by then the story had got much bigger. The takeover news had broken via the old-fashioned Sunday newspapers, with BSkyB quickly confirming negotiations over a £575m bid. United were expected to inform the London Stock Exchange, as PLCs are legally obliged to do, on Monday morning – but two days passed, amid a flurry of speculation and hair-tearing, until the club confirmed on Wednesday morning that it had accepted a £623.4m bid.

The offer of 240p per share (half as cash, half as BSkyB shares) was a shade more than 50% higher on Friday’s closing stock-exchange value of 159p. Perhaps helped by the feeding frenzy that followed the news breaking on Sunday, United had wrangled nearly an extra £50m on top of BSkyB’s original eyebrow-raiser, but the broadcaster didn’t blink. By the time hands were shook, they’d brought the big dog to the table.

Rupert Murdoch, whose News Corp owned 40% of BSkyB but whose hand was definitely on the tiller, had long recognised that media needed sport. Having bought ailing newspaper The Sun in 1969, the Aussie had revitalised it by revamping the football coverage, notably going big on transfer gossip – a content innovation that rings down the ages. He had also quickly identified that the Premier League rights could establish Sky, which is why he was happy to do as Alan Sugar suggested and “blow them out of the water” with the £304m bid.

In both cases, the gamble had worked. By now, United were the world’s most profitable football club, its latest annual accounts showing a surplus of £27.6m – remarkable for its sector; the BBC Business section described in a tone of wonder how the club’s “popularity has meant that it earns as much from merchandise sales and advertising as from gate receipts”. But such fiscal success was dwarfed by BSkyB’s latest figures, which showed pre-tax profits rising 22% to £314m.

Nor was this Murdoch’s first venture into wearing a club-branded cap. Naturalised as an American, he had already bought the LA Dodgers baseball club, along with the TV rights to the sport via his Fox network. He also owned slices of the LA Lakers and New York Knicks basketball teams, the latter being on the patch covered by his own mass-market tabloid the New York Post.

Having the media platforms is fine, but if you own the means of (entertainment) production, so much the better. “Broadcasters are increasingly seeking valued added content,” explained industry analyst Nick Battram. “It’s analogous with the software industry, where the value is in the software, not the hardware.

“There’s no point setting up a satellite or cable station unless you can show something that people want to watch and the biggest pull is football, especially Premiership football. This is why you have BSkyB trying to buy into Manchester United, as they recognise there is only one way these rights are going to go and that is up.”

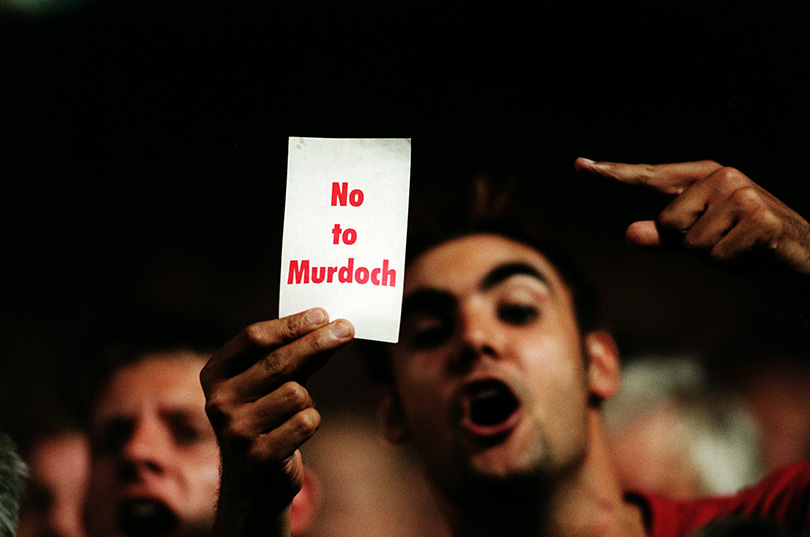

The opposition masses

As had happened 14 years previously with Murdoch’s old press rival Maxwell, the takeover news sparked immediate and visceral opposition, largely targeted at chief executive Martin Edwards. But whereas Cap’n Bob had only been offering £10m, this was a rather more sizeable slice of cash – easily enough to buy a big wall to surround your house in Cheshire and install double glazing to drown out the protests.

The BBC reported that as the largest single shareholder, Edwards would see his 14% stake increase in value to £87m – around £30m more than if he had sold on the open market the previous Friday. Maurice Watkins, the club lawyer who had attended the Heathrow meal mainly to sign administrative papers, saw his 2% slice grow from £8m to a theoretical £12.5m.

But while many United fans derided the incumbents, many more feared the incoming administration. As fans are wont to do, they reached back into history to defend the honour of their publicly-listed club. “The success of Manchester United has been built up by the likes of Matt Busby and Alex Ferguson,” raged Andy Walsh, chairman of the Independent Manchester United Supporters Association (IMUSA). “One man does not have the right to sell that success on in such a fashion. Rupert Murdoch will rape and pillage Manchester United.”

Opposition was quickly organised, across all sorts of boundaries. IMUSA received a £10,000 donation from Queen drummer Roger Taylor. After United-supporting journalist Michael Crick railed against the bid via an Evening Standard piece and Newsnight film, he was contacted by advertising guru Richard Hytner, who owned 6,000 shares; with PR maven Richard Lander, they set up Shareholders United Against Murdoch (SUAM).

SUAM worked closely with IMUSA, which tickled Crick: “Andy [Walsh] had been a member of the [hard-left] Militant tendency, while I probably more than any other journalist had been the person who exposed Militant for what they were. Fortunately no journalist cottoned onto this strange alliance.”

Unusually, United fans even gained some sympathy from outsiders, even if some of the opposition came from rivals who feared the worst if the dominant footballing force was strengthened by Murdoch’s media muscle. As the Sunday Telegraph’s sports editor Colin Gibson said: “A lot of the other football clubs in the Premiership will be very, very concerned at this news.”

It wasn’t just the fans who were wary. FA chief exec Graham Kelly warned that, “We have to assess the implications very closely indeed.” A senior Labour backbencher fretted: “If this deal goes through, Murdoch will have a stranglehold on sport in this country.”

That concern reached the front benches. Chelsea-supporting Sports Minister Tony Banks suggested the Office of Fair Trading could order an inquiry: “This can’t be treated as if it were just a normal takeover of one publicly quoted company by another.”

This was confirmed even further up the greasy pole, where the oleaginous Secretary of State for Trade and Industry, Peter Mandelson, reached for a grab-bag of adverbs while pledging that the OFT would examine the bid “very completely and extremely searchingly”.

NEXT: The sky falls in

The sky falls in

Mandelson was right, if verbose. The OFT referred the case to the Monopolies and Mergers Commission, who investigated it for more than four months. In March 1999 they delivered a 254-page report to Mandelson’s successor Stephen Byers, and on Friday 9 April, two days before United’s FA Cup semi-final against Arsenal, Byers grabbed the headlines on the front and back pages.

A hitherto quiet, bespectacled career politician, not at all like his empire-building predecessor, Byers amazed fans, shareholders, MPs and commentators – political and sporting – by announcing that the deal was to be blocked as anti-competitive. “Under almost all scenarios considered by the MMC, the merger would increase the market power which BSkyB already has as a provider of sports premium channels,” Byers explained.

Crick rejoiced in typical style: “The most remarkable thing is that a politician has at last stood up to Rupert Murdoch.” “It is a good day,” agreed Labour MP Chris Mullin. “It is clear evidence that the Government is not necessarily intimidated by Mr Murdoch, despite the size of his empire.”

BSkyB quietly fumed. Much had been made of Murdoch, having a foot in both camps, being able to use insider information about TV rights bids – as Alan Sugar had done to help Sky win its first Premier League contract.

“We said at the outset that Manchester United had one vote in 20,” insisted Sky Sports MD Vic Wakeling. “We have then said, if people are concerned about this, we will agree to stand down during any TV contract talks, so we can't see why there would be a competition issue.”

BSkyB chief exec Mark Booth, whose Heathrow lunch had kicked off the whole takeover, was more pointed and threatening: “This is a bad ruling for British football clubs, who will have to compete in Europe against clubs who are backed by successful media companies.”

But Booth was wrong on most counts. The MMC mandarins had carefully considered their options and decided it might not be good if the biggest broadcaster owned the biggest club. The blow to TV companies had knock-on effects elsewhere, especially further down the league, but they were due more to unsustainable overspeculation in a tech boom that was inevitably followed by bust.

On the pitch, life went on as normal, more or less. A month later, Manchester United completed an unprecedented Treble by winning the Champions League in Barcelona against Bayern Munich. It was the sort of narrative that lends itself to heavily-mediated history. United, and Sky, still trade on it to this day – but they do so separately.

What happened next?

Manchester United won nine of the next 15 Premier League titles, and no monopolies commission could stop them. Nor could an enormously unpopular takeover by the Glazer family in summer 2005, which valued the club at £790m, a price partially raised by leveraging loans against the club’s assets. The club was delisted from the London Stock Exchange in June 2005 after the Glazers reached the 75% ownership that allowed them to do so. The club was relisted, on the New York Stock Exchange, in August 2012.

Martin Edwards continued to lucratively whittle down his shareholding. He resigned as chief exec in 2000, elevating his previous deputy Peter Kenyon to the main role, while remaining as chairman. He resigned as chairman and non-executive board member in November 2002 after various salacious newspaper claims. Although he remains honorary vice-president, his resignation ended 42 years of Edwards family presence on the United board.

Club lawyer Maurice Watkins completed an unlikely double in 2013 by legally representing both Eric Cantona and Stuart Hall. In 2012, he stepped down from the United board after 28 years, switching Old Traffords to join Lancashire CCC. From 2013 to 2017, he was chairman of Barnsley FC.

Mark Booth quit as BSkyB chief exec on 28 April 1999, less than three weeks after the takeover bid was blocked. His warning about British clubs failing to compete in Europe did not come true. True, after United’s 1999 win no English side reached the Champions League final again until 2005, but they hadn’t since 1985, and Liverpool’s memorable visit to Istanbul started a run of eight successive seasons featuring eight Premier League appearances in Champions League finals.

On 23 November 1999, BSkyB was forced to sell 2.9m of its United shares to take its slice down from 11.1% to 9.99%, underneath the Premier League’s ceiling of 10% ownership for any individual or company with shares in more than one club – a rule partly introduced to stop any new Maxwellian mergers. Two weeks earlier, BSkyB had bought 9.9% of Manchester City for £5.5m; it already owned a similar slice of Leeds and would also buy into Chelsea and, er, Sunderland. In time, all these part-ownerships would be bought out by incoming takeover attempts; BSkyB sold its slice of Manchester United to JP McManus and John Magnier in October 2003.

Tony Fraher, the fund manager who had predicted that 16 of the 10 top-flight clubs would be owned by the media within two years, left the company. They later changed the name and mandate of the Football Fund: “There was a lot of hype about the growth potential in the sport and media industries and, inevitably, some of this was overdone. To some degree it was not the best thing to have launched then.”

Cable company NTL bit off so much more than it could chew that various Heimlich manoeuvres weren’t enough to stop it going into bankruptcy in 2002, saddled with £12 billion of debt. Its subsidiary Premium TV had a deal to produce the websites for all Football League clubs; this was hastily restructured from £35m to £5m with an increased share of future revenue.

Football League clubs had already suffered from the £125m collapse of ITV Digital, which went into administration in March 2002 after struggling to stand up its £315m contract to show League matches. The League sued ITV Digital’s joint owners Granada and Carlton and lost.

Boro TV closed in in July 2005 after NTL withdrew funding. The name lives on via former producer Adam Nolan, who now does Boro’s in-house matchday highlights and season videos.

Although club channels didn’t become the roaring success many had envisaged, MUTV became the most popular. Having learned the broadcast ropes, United eventually bought out ITV’s 33% in November 2007 – for £3.3m, around a tenth of the fee Fergie had just paid for Anderson and Nani – and BSkyB’s similarly-sized slice in January 2013, to wholly own the channel.

Rupert Murdoch replaced Mark Booth as BSkyB chief exec with Tony Ball; four years later, he replaced Ball with his son James Murdoch. He still has his fingers very actively in various media pies: in July 2016, at the age of 85, he was named the acting CEO of Fox News after the incumbent resigned due to claims of sexual harassment.

Stephen Byers was forced to leave the Cabinet after it emerged that his political advisor had sent an email on 11 September 2001 saying it was “a very good day to get out anything we want to bury”. He was later derided as part of the 2009 furore over MP’s expenses claims, and banned from parliament for two years after the 2010 cash-for-influence scandal.

IMUSA continues to represent Red Devils fans. In 2005 its erstwhile chairman Andy Walsh became one of the founders of FC United of Manchester, a phoenix club protesting the Glazers’ involvement. Walsh left the Rebels in 2016 and is now on the board of Wythenshawe Amateurs.

Michael Crick’s 2002 book The Boss: The Many Sides of Alex Ferguson won him no fans among the United hierarchy, but it’s among FourFourTwo’s 50 Best Football Books. SUAM became Shareholders United and then the Manchester United Supporters’ Trust (MUST), the largest such trust in the country with 200,000 members. It hopes to buy a stake in the club if the chance arises.

Gary Parkinson is a freelance writer, editor, trainer, muso, singer, actor and coach. He spent 14 years at FourFourTwo as the Global Digital Editor and continues to regularly contribute to the magazine and website, including major features on Euro 96, Subbuteo, Robert Maxwell and the inside story of Liverpool's 1990 title win. He is also a Bolton Wanderers fan.